Our Execution Process

Our commitment to ongoing business development includes nurturing relationships with contacts/companies in the industry to determine which companies might be looking to be acquired, interested in implementing technology into their companies, and/or looking to make an acquisition in the technology market.

Our team has very close relationships with leadership across the Enterprise Software market.

Domaine seeks to turn around underperforming companies in the. lower-mid market quickly based on the background/ network/ expertise of the team, consistent with our Methodology.

It closely evaluates the company, focussing on pipeline, technology, and back office efficiency.

It closely evaluates the company, focussing on pipeline, technology, and back office efficiency.

Domaine reviews both on off market deals when evaluating what to invest in and how to build the overall fund investment strategy.

As former OperatorsDomaine resources have real-world experience in identifying issues, understanding how to enhance practices, and knowing how best to effectively accelerate PC performance.

Domaine has considerable experience positioning a PC for exit. As PC performance improves, our team seeks to in regular conversations with potential Strategic/Financial investors.

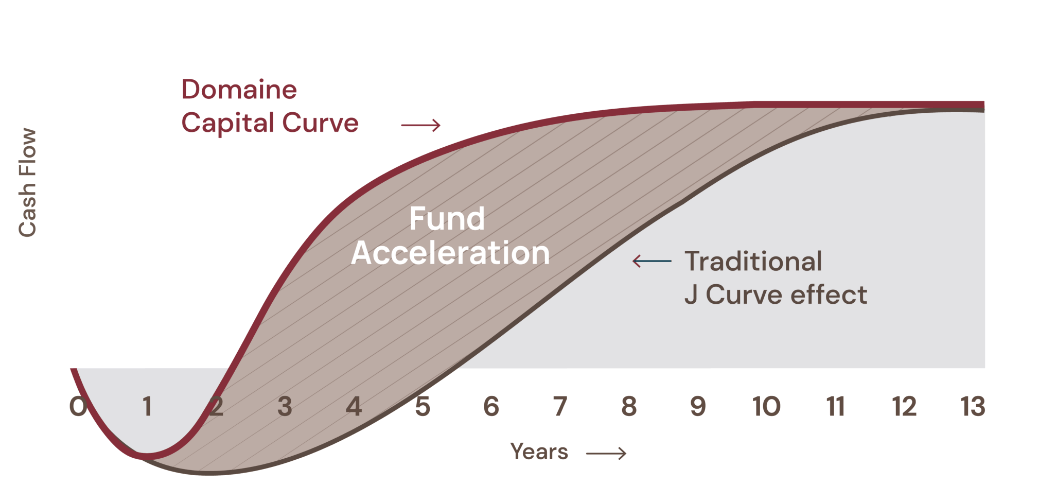

The Domaine Capital Effect

Through the Domaine Capital Methodology we seek to produce results for the fund which accelerate outcomes when compared to a traditional J-Curve.

Relevant Articles

Through the Domaine Capital Methodology we seek to produce results for the fund which accelerate outcomes when compared to a traditional J-Curve.

Recession Resilient

As the world grapples with the ongoing economic challenges of the COVID-19 pandemic, many inve...

READ MORE

A Guide to the Enterprise Software Market

The enterprise software market is a segment of the global software market that includes all...

READ MORE